Tapping the Untapped : Opportunities for Businesses

Every single social and global issue of our day is a business opportunity in disguise.” – Peter Drucker, management guru

Poor and low-income families have many unmet needs from food, water, shelter to sanitation, healthcare and livelihoods. There are 3 billion people living on less than $2.50 per day—nearly half of the global population.

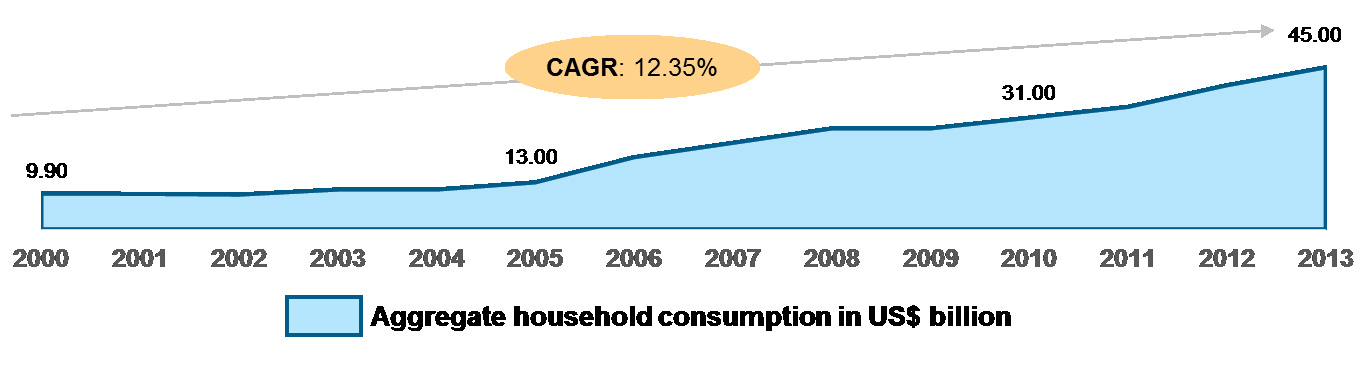

This low income market with its size and potential latent demand provides huge opportunity for business. Taking Kenya as an example, the Kenyan consumer market is growing at a fast pace, household consumption expenditure has grown at a CAGR of 12.35% in the past 13 years[1] with low-income households comprising 86% of total consumption[2]. Typical monthly consumption levels of a low-income household are KSH 5,472 (US$ 60) for rural areas and KSH 10,953 (US$ 109) for urban[3].

The future projections are also promising. Growth trends are likely to continue, with the result that a portion of low-income consumers today will grow to become middle-income consumers. In the next 15 years Kenya’s population set to grow by 30%, urbanisation to increase by 45% and poverty set to reduce by 3100 basis points[4].

Whilst many corporates and small and growing businesses (SGBs) deal with this low income market either as suppliers, customers or employees for the most part, markets are not set up to service this population. For example, poor infrastructure means that it is particularly difficult and expensive to reach the low income market.

[1] Index mundi, World Bank

[2] Source: IFC’s consumption database

[3] Kenya Inequity Report, Society for International Development

[4] World Bank Development Indicators

Success Stories

Opportunities in low-income markets are frequently considered riskier, lower margin, or at least longer term. Even Vodafone’s M-PESA mobile money transfer service, which now reaches 18 million users and moves more than £500 million through the Kenyan economy every month, required a £1 million matching grant from the UK’s Department for International Development to get started and cover the initial risk of developing a new product.

Yet, some corporates that have tackled this market have experienced astounding success:

Financial Inclusion: Equity Bank from being declared technically insolvent in 1993 currently has more than 8 million customers making it the largest bank in terms of customer base in Africa with nearly half of the total bank accounts in Kenya.

Social Durables: The solar lantern market has grown by more than 200% in the last 3 years with c 700,000 solar lanterns sold to off-grid families in rural Kenya. Use of solar lighting has increased fourfold from barely 2% in 2009 to about 8% in 2013[1]. d.light and Greenlight Planet emerged as leaders in the solar lanterns market and Mkopa headed the market for solar home systems.

Consumer Products: Unilever has specifically tailored products for the low income market, in terms of product size, price, alternative distribution strategies and seen resounding success and made sustainable living part of its vision.

By addressing latent needs for the low income customer, these corporates were able to achieve financial success as well improve access to finance, energy, water, food and create employment. This in turn, lays important foundations for further growth: increasing incomes, greater purchasing power, more skilled and sophisticated workers, suppliers, distributors, and retailers, and more stable societies.

How can businesses tap this potential?

While low-income consumers represent an attractive market, the reality is that reaching them is difficult. Challenges include sparse population with uneven population density, nascent last-mile infrastructure, predominantly informal retail networks, latent demand and a limited ability to pay upfront.

One route into this market is through partnerships between corporates and SGBs. While corporates have scale and resources and have highly qualified teams, they are confronted with high opportunity costs of investing in products with uncertain return. Due to the higher perceived risk, many business opportunities remain untapped.

SGBs, on the other hand, often operate on a limited scale and are constrained by limited human capital and financial resources. By working together, corporates and SGBs can address key challenges that prevent product or business model innovations from scaling up, creating “win-win” situations for both sides and accelerating business growth, while increasing social impacts.

A recent examples of successful collaboration in Kenya include the Total/d.light partnership whereby the innovative, reliable solar technology and phone charging solutions by d.light are sold through Total’s extensive distribution network in Kenya and Africa enabling off-grid, low-income communities to meet some of their most basic everyday needs.

[1] Kenya Qualitative Off-Grid Lighting Market Assessment, International Finance Corporation

What next?

It is fitting to end with reference to C.K Prahalad’s assertion of the fortune at the bottom of the pyramid. The opportunity to make profit whilst creating impact exist particularly in Kenya and Africa as shown in the examples above. It is just a matter of taking the next steps.

Any parties interested in exploring collaboration opportunities in Kenya please reach out to us directly. With the support of USAID, we have recently launched a Collaboration for Impact Facility to help set up such partnerships and we’ll be happy to discuss how your organization can get involved.