Designing A Unique Blended Finance Facility to Scale Solar Solutions In Africa

Clients

International Solar Alliance

Geography of work

Africa

Sector

Clean Energy

Situation/Challenge

Africa needs to raise at least USD 60 billion to reach its 70 GW solar potential that can address the universal energy goals. Solar energy is a growing and important contributor towards these goals as well as for accelerating the green economy and low carbon growth in Africa. Over 40% of energy capacity addition between 2021 and 2030 will come from solar PV in Africa . However, despite these positive developments, investment in solar still lags in the region. Africa accounted for USD 18 billion, just 2% of global solar PV investments, in the period 2010-2020 . This is primarily due to the nascent stage of the solar sector, limited regulatory support environment, and lack of availability of domestic capital.

Given the lack of domestic funding, various blended finance facilities have been launched to fund solar energy deployment in the continent with the objective of catalyzing commercial capital. Deployment of the funds from these facilities, however, remains low. Multi-country blended finance facilities also exclude many local companies due to strict screening and evaluation criteria. Further, the majority of technical assistance flows to third party consultants for project preparation, rather than business model validation, where solar entrepreneurs need more support. Investments also remain skewed towards certain geographies (Southern and Northern Africa) and certain solar segments (SHS and mini grids).

The International Solar Alliance (ISA) engaged Intellecap to design a blended finance risk mitigation facility for the solar sector in Africa. The ISA is on a mission to solarize the world by 2030 while seeking to help countries mobilize USD 1 trillion of investment for massive deployment of solar technologies and expand solar markets. This blended finance facility is a part of its mandate to scale solar solutions in Africa and crowd in private capital.

Solution

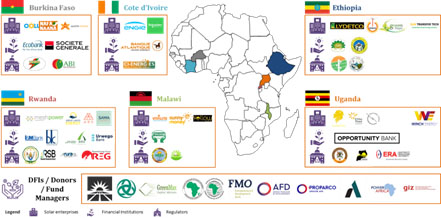

As part of the first phase, Intellecap undertook a high-level assessment of Africa, including the ISA partner countries in the continent, to understand their suitability for solar based investments. The assessment evaluated countries in the continent on the basis of three key parameters: (i) impact potential; (ii) market potential; (iii) ease of implementation. This assessment resulted in the selection of five focus countries – Burkina Faso, Uganda, Ethiopia, Malawi, and Rwanda – for a deep-dive study.

The first phase was followed by identification of solar technologies the facility will target across the focus countries. This was undertaken through a detailed market scan, with stakeholder consultations, from both a demand as well as a supply side perspective. The demand side assessment evaluated the needs and challenges of solar enterprises and technologies across Residential, Institutional, and Commercial categories. On the supply side, we aimed to understand industry growth prospects and challenges from solution providers, including SHS aggregators and distributors, roof top developers, and EPC companies.

Simultaneously, we assessed the existing financial services landscape in each of the five countries. We consulted with a cross spectrum of financial institutions – commercial banks, NBFIs, MFIs – in each focus country. The consultations aimed to understand key lending terms and challenges in providing capital to the solar sector, segmented by different solar technologies. Intellecap also evaluated existing blended facilities led by DFIs and/or private fund managers. This assessment helped ensure that the proposed vehicle does not duplicate already existing interventions and explores possible collaboration to economize on time and scarce resources.

The final phase of the project focused on designing the blended finance risk mitigation facility. This was informed via a total of 180+ stakeholder conversations (solar enterprises, financial institutions, regulatory agencies) from the five focus countries, and DFIs, donor agencies and fund managers from across Africa.

We mapped the findings from secondary and primary research to understand overlaps between countries in terms of target solar technologies, financing needs, and potential interventions that can address those needs. Accordingly, we designed potential interventions and evaluated them on the basis of: (i) ease of implementation; (ii) effectiveness in meeting unaddressed needs; (iii) potential to scale. This was followed by a workshop to seek input from key stakeholders over the proposed interventions and arrive at the final design. The workshop also allowed us to secure soft buy-in from stakeholders. The final facility design was detailed, including capital providers, instruments, high-level terms, and focus technologies. Intellecap also evaluated the regulatory and tax feasibility of the facility, including the potential pooling locations and mechanisms.

Outcome and Impact

Intellecap delivered the final design of the blended finance risk mitigation facility. The proposed approach sought to meet the unaddressed needs through a combination of concessional and commercial capital (including local currency financing) with risk mitigation measures and capacity building that enables commercial viability of the focus solar technologies. It focused on investing across solar technologies – off-grid solar, rooftop solar, productive use solar, utility scale solar – across Africa through a country specific intervention approach.

The facility included an Investment Fund to provide concessional capital with risk mitigation instruments, and a Technical Assistance Fund to support an enabling regulatory environment, demand aggregation, customer acquisition, and access to affordable capital. Further, a Solar Insurance Premium Supporting Fund was proposed to support the project developers. We also included a Solar Project Guarantee Fund to support projects at the time of default and reduce the risk of early closures / bankruptcy.

By removing the financial, technical, and regulatory barriers, the facility would be able to enable an estimated USD 5-10 billion worth of commercially viable investments into solar energy. This would increase the generation capacity of the continent, benefiting around 35-40 million households to gain energy access. Through solar energy, the share of renewables in the overall energy mix of Africa would increase multifold resulting in over a mn tons of CO2 emission reduction.

Key Learnings:

- The existing blended finance facilities are not equipped to cater to the solar market of Africa due to lack of risk appropriate returns in the absence of risk mitigation, lack of bankable pipeline, limited understanding of solar technologies and risk models, small size of projects such that ticket size remains too small for existing investors, and strict qualifying criteria that exclude majority of local companies from obtaining funding.

- The Technical Assistance (TA) currently offered to solar sector stakeholders in Africa is largely limited to project preparation support.

- Non bankability of the solar sector could be attributed to the non-availability of affordable insurance products (specifically designed for the solar sector). It is primarily because the sector is nascent with limited historical data to determine the project viability for 25 years (lifetime of solar projects).

- Local financial service providers lack adequate experience to evaluate the sector and business models, hence they refrain from financing solar enterprises as well as offering consumer financing options.

- SHS and mini grids segments emerged as high potential segments, however, critical challenges in accessing debt for these segments were high interest rates (double digits), high collateral requirements (100-200%), and small ticket size requirement per project/enterprise (USD <1 million).

- Solar companies raise capital at high interest rates (~13-20%) which constrains their growth. This is primarily due to a high-risk perception of the solar sector, lack of established business models, and non-acceptance of receivables as collateral by financial institutions.

- Solar PV funding was largely skewed towards South Africa, with the West, East and Central received significantly low levels of funding. Concentration of solar energy installations in East Africa (~1 GW) and West Africa (0.76 GW) are significantly low, particularly in proportion with their large rural populations.

- Local currency financing is critical given the high foreign currency risk in certain key countries of Africa.

Behind the Scenes

- There is significant interest to invest in the solar sector, however, funding institutions, including DFIs and fund managers, were particularly interested to understand the additionality aspects of the blended finance facility in view of the multiple such facilities existing for the solar sector in Africa.

- Practical business challenges are not well understood by policymakers who operate within regulations with limited understanding of business needs and market trends. Although, alignment of the facility with national and regional policies is critical for implementation and obtaining buy-in from key stakeholders.

- Lack of components due to delayed shipments during the COVID pandemic resulted in entrepreneurs resorting to innovative measures to secure financing and complete projects.

Testimonials:

Fund Manager, added that “The fund would have to have a broad multi sectoral focus. A good portion of its capital would need to go into grid connected projects. But the challenge there is that the space is already a bit crowded with players who have not been able to commit capital. You see the Fund Managers that were originally designed to focus on the grid connected space have migrated into the C&I space.”

Fund Manager added that “90% of all capital flows in energy access has gone to international companies due to issues of fairness and equity. Not supporting local economic development is not a sustainable development model. Foot on the ground and understanding of the local culture is very important”

Fund Manager added that “To achieve SDG 7 in Africa, the amount of capital needed is staggering. Only by leveraging a substantial amount of private capital this would be possible. Mainstreaming private financing is critical. You have to bring local financial institutions and local currency financing.”

SHS Enterprise added that “The bankability of SHS is a big challenge. The SHS is still new in Burkina Faso, hence local banks do not understand the sector. When you present a business plan of SHS with PAYG to local banks, they don’t understand it and they cannot serve you because they are hesitant about its bankability. Another big issue is the required guarantee by local banks. If you don’t have 100% collateral, you can’t get money from local banks”

Local Financial Institution added that “The enterprises really need guarantees. There is a huge appetite for solar energy in Burkina Faso, and enterprises are able to present credible business plans but they need guarantees for their projects since it is still considered risky.”

SHS Company added that “While we have tried to get funding from commercial banks, we have not succeeded. Additionally, the due diligence process and interest rate of 24-34% annually is restrictive. Further, access to forex even in a pre-COVID environment has been tough.”

National Development Bank added that “One of the reasons why there was no breakthrough with banks: they wanted to provide financing the way they usually do. This does not apply to the solar companies. They want stringent collateral but solar companies can pledge only receivables and banks do not have experience in getting receivables as guarantee and then they also discount the receivables so it does not allow the companies to get financing.”

Solar Enterprise added that “Mini grid and C&I are the fastest growing segments, and a more sustainable model. The productive use of energy has a higher impact than simple SHS. TVs, fridges, milling machines and electric mobility add greater value to quality of life of beneficiaries.”