Fintechs to drive financial inclusion or will banks save the day?

At a recent digital banking conference in Africa, I was asked if fintech is sustainable. The response was simple – fintech is not singular. It is an amalgamation of multiple digital financial services trends across regions, and across payments, lending, and banking.

The question is which of these are solving a real problem vs those solving a perceived problem. There are a few trends out here that I like, which are solving real issues, which will sustain, and merge with the overall financial services ecosystem:

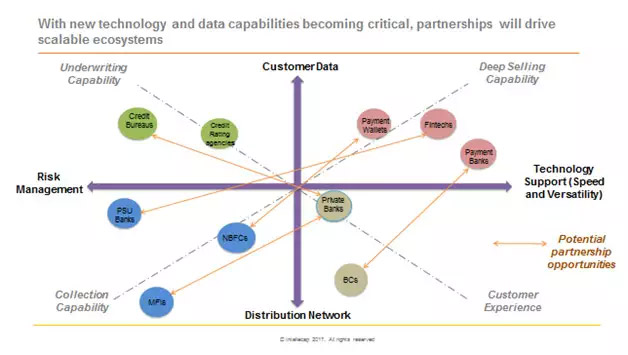

Disintermediation of the lending value chain – Banks would traditionally source, acquire, underwrite, onboard, collect and service customers. Most would do some parts well, and a few parts not so well. This is increasingly now being solved by the entry of new ‘customer owning’ entities into the game, who will acquire, owners of data who can underwrite, and the lenders who can lend and collect. This makes partnerships key.

However, the cost of acquisition, collections and data partnerships is turning out to be quite prohibitive (upto 6-8% in some cases), especially in telco-dominated markets, for example Kenya, which is driving the fintech business models towards non-feasibility.

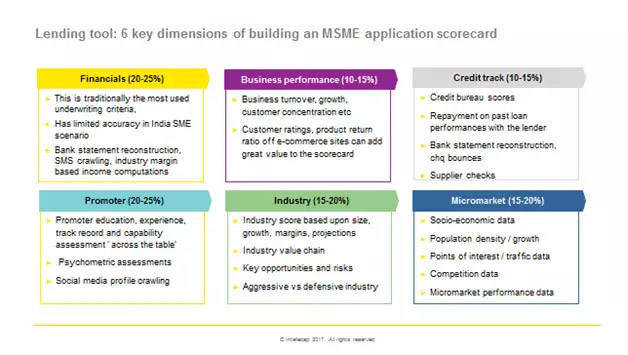

Alternate data – Lending to the bottom of the pyramid and micro SMEs has always been the problem to solve for financial institutions, due to lack of documented income and collateral. Non-traditional data promises to come in and provide an alternative.

However, most such data algorithms do not seem to be working out. Many fintechs across India, Africa etc, are running NPAs upwards of 8-10%, including some of the flagbearers of the phenomenon, but that is not out in the public domain, and typically shoved under the carpet. The main reason for this is that the algorithms are raw and untested. They have not run their credit cycles yet.

Sometimes all dimensions do not get covered or with the wrong weightages. It will take time for fintechs to refine them and scale them. You cannot short-circuit that process and it won’t be a lot more blood on the floor. VCs will also need to learn to underwrite the scoring models than just business models (they should work more with business consultants who understand both!)

Payments – Payments as an innovation is done. It’s commodity now. Fintechs who continue to invest in incremental experiences will find it difficult to scale. The trend to watch for will be digital ecosystems. What I mean is digital marketplaces, the likes of Ping-an and Alipay, serving the integrated needs of the digital consumer a.k.a the millennials, enabled through digital payments and leveraging financial services cross-sell sitting on top of all of this, as the revenue driver.

The catch here is that the only region where this has scaled so far is China, where traditional banks do not even look at retail or MSME customers. Banking competitive markets is another game.

Notwithstanding the above opportunities, If I critically look at the steady state business model of a pure play lending fintech – with blended cost of funds at 15% plus, 6-8% cost of acquisition/collections/data partnerships, 2-3% operating cost, plus NPAs, we are talking about a lending rate in excess of 25%. This automatically creates a downward spiral of negative selection and a self-fulfilling prophecy with regards to the NPAs. You cannot realistically expect all customers who borrow at this rate to earn a higher margin on their business and pay it back.

And, this is also the reason why financial inclusion is running in the reverse direction in many markets, with customers borrowing at high rates and going bust.

For fintechs, the inherent potential advantage of near-zero cost of transaction, or data driven risk-based pricing is also lost in this operating model. And what this means for fintechs running on equity funding and adrenalin, it is only a matter of time.

The above is also a golden opportunity for banks – They have the distribution, the risk management capabilities, low-cost funds and the customers. And the ability to acquire or partner with data and technology capabilities to offer advanced services such as microsegment based cross-sell (as they have the customers), risk-based pricing (have low-cost funds) etc. And real financial inclusion if they can find the will.

The writer leads the Financial services consulting practice for Intellecap.