TRENDING

-

SSAGA – Benefitting small-scale farmers by fostering innovations and collaboration across the Global South

Published: March, 2025 -

Sankalp Bharat 2024-Post Summit Report

Published: March, 2025 -

Reorienting The Private Sector To Enable Climate-smart Agricultural Solutions To Address Gender Inequalities

Published: February, 2025

Nudging The Investment Ecosystem By Incentivizing Impact

PUBLISHED: June, 2018

Opportunities in Incentivizing Impact in Financing Small and Growing Businesses in Developing & Emerging Markets

This paper is a summary of fresh ideas on how to channel more capital into impact investing and incentivize impact creation. Building on insights generated by experts at the BMZ hosted conference Financing Global Development – Leveraging Impact Investing for the SDGs, the paper furthers the conversation on Impact Measurement and Management, IMM 2.0, through brainstorming practical ideas and viewpoints in the impact investing value chain: those who provide capital, those who manage it, and those who receive it. This included close to 50 stakeholders, including fund managers, DFIs, intermediaries, entrepreneurs, governments, CSOs and others.

The discussion, conducted in the form of a ‘design lab’ by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, Intellecap, and the Swiss Agency for Development and Cooperation (SDC), aims to start a conversation on how to maximize impact by channeling capital into small and growing businesses (SGBs) as a way to expedite achievement of SDGs (Sustainable Development Goals). During the session, industry leaders like FMO, Vox Capital, and Roots of Impact had shared case studies of good practices in incentivizing impact along the investment chain. This formed the basis of brainstorming on development of new ideas on innovative instruments that could nudge the ecosystem towards more actively pursuing and scaling impact.

The result is an analysis of the barriers in the impact investment value chain highlighted during the stakeholder conversations, and key insights on how to overcome them (for example, the need for transparency, standardization, leadership, etc.). In addition, the workshop collated a list of potential ‘wild ideas’ to like impact currency, impact rewards, impact index, online market places for impact auctioning, and a give-back distribution impact support system, designed to incentivize increased levels of investment along the value chain. The practical approaches suggested by stakeholders fit well with the existing impact measurement and monitoring frameworks like GIIN’s IRIS and Intellecap’s PRISM and hold the potential to guide impact capital more efficiently by leveraging good practices.

The Financial Lives of Government Employees – Potential of Digital Finance in Sierra Leone

PUBLISHED: July, 2018

This report documents findings from research on the financial lives of government employees in Sierra Leone, commissioned by the Government to People Payments Project – Building Digital Ecosystem funded by USAID. Intellecap supported UNCDF, Government of Sierra Leone and Bank of Sierra Leone for conducting the research.

There are 80,000 government employees in Sierra Leone who receive salaries digitally in their bank accounts. Insights about their financial lives can help build a viable business case for DFS to expand access to a wide range of financial services for underserved communities in Sierra Leone. Such insights can inform strategies and use cases that the UNCDF and the Government of Sierra Leone can develop to promote DFS in the country. The National Strategy for Financial Inclusion 2017 – 2020 also refers to the need to identify and digitize use cases that will lead to habitual usage, and achieve Sierra Leone’s commitments to the ‘Better Than Cash Alliance’.

Recognizing the need and opportunity, UNCDF supported the Financial Lives Survey of government employees who receive their salaries digitally in Sierra Leone. Intellecap designed the survey to understand how government employees utilize salaries transferred into their bank accounts, their awareness of and access to DFS, avenues to use them and their perceptions about financial services and digital financial transactions. This report contains insights from the survey about potential customers of DFS and recommendations on use cases that could be piloted as an initial step to improve DFS adoption in Sierra Leone.

Replication of Intellecap’s Ecosystem Based Approach in East Africa

PUBLISHED: July, 2018

Intellecap has sought to replicate its ecosystem-based approach to East Africa by bringing

together capital, knowledge and networks to support SGBs at two levels: (i) provide direct support

to SGBs in the form of acceleration, fund-raising, technical assistance, innovation transfer, and

market linkages, and (ii) discover and engage critical ecosystem players such as corporations

(both local and international), accelerators, other development sector players in supporting SGBs.

In the three-year period since the launch of our initiative to replicate our ecosystem-based

approach for accelerating entrepreneurship support to SGBs in East Africa, we have received

generous support not only from our funders, but also from a number of local and international stakeholders such as development institutions, private sector entities, and industry associations.

Over the last year, we have replicated our advocacy platform (Sankalp), angel investment network

(I3N) advisory services (consulting & investment banking), virtual incubation platform

(StartupWave) and impact measurement platform (PRISM) as envisaged at the beginning of our

programmatic support. The development and adaptation of StartupWave for East Africa has

resulted in over 450 sign-ups for our early stage enterprise support activities and partnerships with

over 30 incubators / accelerators. Similarly, PRISM, our impact measurement platform, has

garnered interest from a wide variety of players to measure the impact of their programs.

All Publications

-

Micro, Small and Medium Enterprise Finance Market in India

PUBLISHED: August, 2012Tags: Financial Services, EntrepreneurshipRegion: AsiaREAD MORE -

On the Path to Sustainability and Scale: A Study of India’s Social Enterprise Landscape

PUBLISHED: April, 2012Tags: Energy, Health, Agriculture, Livelihoods, EntrepreneurshipRegion: AsiaREAD MORE -

Understanding Human Resource Challenges in the Indian Social Enterprise Sector

PUBLISHED: April, 2012Tags: EntrepreneurshipRegion: AsiaREAD MORE -

Indian Microfinance: Looking Beyond The AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012READ MORE -

Indian Microfinance Looking Beyond the AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012READ MORE -

Indian Microfinance Looking Beyond the AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012READ MORE -

Indian Microfinance: Looking Beyond The AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012Tags: Financial ServicesRegion: AsiaREAD MORE -

Finish Line in Sight but Hurdles Remain: A Perspective on the Draft Microfinance Institutions Bill 2011

PUBLISHED: July, 2011Tags: Financial ServicesRegion: AsiaREAD MORE

Micro, Small and Medium Enterprise Finance Market in India

PUBLISHED: August, 2012

The Micro, Small and Medium Enterprise sector is crucial to India’s economy.Although 95% of Micro, Small and Medium Enterprise units are informal in nature, the contribution of the sector to India’s GDP has been growing consistently at 11% per annum, higher than overall GDP growth of 7-8% . Poor infrastructure and inadequate market linkages are among key factors that have constrained the growth of the sector. However, lack of adequate and timely access to finance has continued to be the biggest challenge.

This study by Intellecap, commissioned by the International Finance Corporation (IFC) estimates the size of the MSME finance market in India, identifies challenges and opportunities for private sector participation and potential interventions that can promote activity in this market.

Compass due North East

PUBLISHED: April, 2012

This study was made possible with funding and support from the Deutsche Gesellschafr fur Internationale Zusammenarbeit (GIZ) GmbH.

Ideas for Impact

PUBLISHED: April, 2012

The Sankalp Forum-Samridhi Social Enterprise Recognition and Regional Summit, organized in collaboration with DFID and GIZ, was aimed at supporting social entrepreneurs working in India’s Low Income States (LIS). As part of the Summit, a special “Recognition program” was organized to showcase the most innovative and scalable of these social enterprises. This compendium of case studies showcases the ten finalists at the Sankalp Forum-Samridhi Social Enterprise Recognition 2012.

On the Path to Sustainability and Scale: A Study of India’s Social Enterprise Landscape

PUBLISHED: April, 2012

n India, social enterprises have become a national phenomenon in less than a decade, with a growing ecosystem of supporting players. Yet, despite this impressive growth, little is known about these social enterprises collectively: their geographic and sector distribution, business structure, stage of development, financial viability and funding sources.

This Intellecap Study, which was supported by the International Finance Corporation (IFC) and The Rockefeller Foundation, evaluates the Indian social enterprise landscape with insights gathered from a survey of over 100 for-profit social enterprises and in-depth interviews. It presents detailed analysis and recommendations to assist investors, donors, sector enablers, policy-makers and academics in making informed decisions about their involvement with social enterprises.

Understanding Human Resource Challenges in the Indian Social Enterprise Sector

PUBLISHED: April, 2012

Access to capital and human resources are the top two challenges Indian social enterprises face. Already juggling to bring together capital, a viable business model and market knowledge, social entrepreneurs face human resource (HR) challenges that impact their ability to scale, become sustainable and achieve social impact.

This Study, supported by Potencia Ventures and the International Finance Corporation (IFC), provides data and insights from an online survey that Intellecap conducted of social enterprises, which garnered over 100 responses. The findings are further examined with in-depth qualitative interviews with over 50 social entrepreneurs, sector enablers and impact investors. The report covers the challenges of recruitment, capacity building, talent retention and team-building that drive scale. It is the first of its kind to provide insight into this important issue and challenge for all social enterprises.

Indian Microfinance: Looking Beyond The AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012

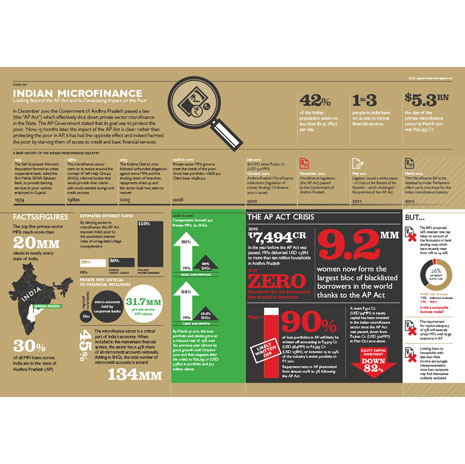

In December 2010 the Government of Andhra Pradesh (“AP”) passed a law (the “AP Act”, originally conceived in October 2010) which effectively shut down private sector microfinance in the State. The AP Government stated that its goal was to protect the poor. Now, 18 months later, the impact of the AP Act is clear: rather than protecting the poor, it has had the opposite effect, harming the poor by starving them of access to credit and basic financial services.

Over 9 million households in AP have been affected as access to finance has dried up and lending by MFIs in AP has dropped to virtually zero from INR 7,494 crore (Cr.) (USD 1.5 billion1) in the year prior to the AP Act. This means that millions of people that depend on MFIs to finance their entrepreneurial pursuits and smooth household incomes have been left with no alternative, other than to return to the village moneylender.

The damage has not been limited to AP alone; indeed the impact already has and will continue to affect access to finance for the poor in other states, making this not just an AP problem, but rather a pan-India problem.

The AP Act eliminated private sector microfinance by making it impossible for MFIs to collect outstanding amounts or provide fresh loans to clients. As of today, over INR 6,000 Cr. (USD1.2 billion) of uncollected loans remain outstanding in AP. Because the MFIs are not permitted into the field, they cannot collect the outstanding amounts nor make fresh loans to the millions of poor households that depend on them as their primary mainstream source of credit. And since MFIs cannot collect the funds locked up in AP, they are unable to pay back their lenders, which include India’s large public and private sector banks such as SBI, SIDBI, ICICI and others.

Indian Microfinance Looking Beyond the AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012

In December 2010 the Government of Andhra Pradesh passed a law (the “AP Act”) which effectively shut down private

ector microfi nance in the State. The AP Government stated that its goal was to protect the poor. Now, 15 months

ater, the impact of the AP Act is clear: rather than protecting the poor in AP, it has had the opposite effect and

ndeed harmed the poor by starving them of access to credit and basic fi nancial services.

Indian Microfinance Looking Beyond the AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012

In December 2010 the government of Andhra Pradesh (“AP”) passed a law (the “AP Act”,originally conceived in October 2010) which effectively shut down private sector microfinance in the State. The AP Government stated that its goal was to protect the poor. Now, 18 months later, the impact of the AP Act is clear: rather than protecting the poor, it has had the opposite effect, harming the poor by starving them of access to credit and basic financial services.

18 months later, the impact of the AP Act is clear: rather than protecting the poor, it has had the opposite effect, harming the poor by starving them of access to credit and basic financial services.

Over 9 million households in AP have been affected as access to finance has dried up1 and lending by MFIs in AP has dropped to virtually zero from INR 7,494 crore (Cr.) (USD 1.5 billion5) in the year prior to the AP Act. This means

that millions of people who depend on MFIs to finance their entrepreneurial pursuits and smooth household incomes have been left with no alternative, other than to return to the village moneylender.

The damage has not been limited to AP alone; indeed the impact already has and will continue to affect access to finance for the poor in other states, making this not just an AP problem, but rather a pan-India problem.

The AP Act has severely impacted the viability of private sector microfinance in India by making it impossible for MFIs to collect outstanding amounts or provide fresh loans to clients. Because the MFIs are not permitted into the field, over INR 6,000 Cr. (USD1.2 billion) of loans remain uncollected in AP today. For the same reason, MFIs cannot make new loans to the millions of poor households that depend on them as their primary source of credit. And since the uncollected funds are locked up in AP, they are unable to pay back their lenders, which include India’s large public and private sector banks such as SBI, SIDBI, ICICI and others.

Indian Microfinance: Looking Beyond The AP Act and its Devastating Impact on the Poor

PUBLISHED: March, 2012

In December 2010 the Government of Andhra Pradesh (“AP”) passed a law (the “AP Act”, originally conceived in October 2010) which effectively shut down private sector microfinance in the State. The AP Government stated that its goal was to protect the poor. Now, 18 months later, the impact of the AP Act is clear: rather than protecting the poor, it has had the opposite effect, harming the poor by starving them of access to credit and basic financial services.

A study by Legatum Ventures, with contributions from Intellecap.

Finish Line in Sight but Hurdles Remain: A Perspective on the Draft Microfinance Institutions Bill 2011

PUBLISHED: July, 2011

The Ministry of Finance of the Government of India unveiled draft legislation earlier this month,

aimed at bringing the microfinance industry within a central regulatory framework, and has

opened it up for comment and feedback from various stakeholders.

The draft „Micro Finance Institutions (Development and Regulation) Bill 2011‟ comes nearly

nine months after the Andhra Pradesh State Government passed an ordinance – later passed into

state law – that imposed stringent restrictions on microfinance firms, particularly in terms of

recovery and interest rates, and practically froze bank lending to the sector.

The size of the microfinance industry in India is estimated to be about Rs24,000 crore, of which

Andhra Pradesh alone is estimated to account for almost a quarter, or Rs7,400 crore.

The AP law practically paralysed the microfinance industry, forcing some of the largest MFIs to

enter corporate debt restructuring programs. The effect on smaller firms has been even more

catastrophic.

Even now, the AP government is defending a court case filed in the state High Court against its

MFI Act.

The draft Bill, though late in coming, is welcome, and will help resolve long-festering

uncertainties about interest rates, margins, and an appropriate regulatory structure for the

industry, while freeing up MFIs from the purview of differing state-level moneylending statutes.

However, the industry might have to wait a while before it can breathe entirely easy – the

monsoon session of Parliament is due to run August 1 through September 8, and it is anybody‟s

guess if the Bill will be taken up in this session, or indeed if it will pass.

Reports & Policies

Our Impact Map

Sign up for our newsletter

© Copyright 2018 Intellecap Advisory Services Pvt. Ltd. - All Rights Reserved