TRENDING

-

SSAGA – Benefitting small-scale farmers by fostering innovations and collaboration across the Global South

Published: March, 2025 -

Sankalp Bharat 2024-Post Summit Report

Published: March, 2025 -

Reorienting The Private Sector To Enable Climate-smart Agricultural Solutions To Address Gender Inequalities

Published: February, 2025

Nudging The Investment Ecosystem By Incentivizing Impact

PUBLISHED: June, 2018

Opportunities in Incentivizing Impact in Financing Small and Growing Businesses in Developing & Emerging Markets

This paper is a summary of fresh ideas on how to channel more capital into impact investing and incentivize impact creation. Building on insights generated by experts at the BMZ hosted conference Financing Global Development – Leveraging Impact Investing for the SDGs, the paper furthers the conversation on Impact Measurement and Management, IMM 2.0, through brainstorming practical ideas and viewpoints in the impact investing value chain: those who provide capital, those who manage it, and those who receive it. This included close to 50 stakeholders, including fund managers, DFIs, intermediaries, entrepreneurs, governments, CSOs and others.

The discussion, conducted in the form of a ‘design lab’ by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, Intellecap, and the Swiss Agency for Development and Cooperation (SDC), aims to start a conversation on how to maximize impact by channeling capital into small and growing businesses (SGBs) as a way to expedite achievement of SDGs (Sustainable Development Goals). During the session, industry leaders like FMO, Vox Capital, and Roots of Impact had shared case studies of good practices in incentivizing impact along the investment chain. This formed the basis of brainstorming on development of new ideas on innovative instruments that could nudge the ecosystem towards more actively pursuing and scaling impact.

The result is an analysis of the barriers in the impact investment value chain highlighted during the stakeholder conversations, and key insights on how to overcome them (for example, the need for transparency, standardization, leadership, etc.). In addition, the workshop collated a list of potential ‘wild ideas’ to like impact currency, impact rewards, impact index, online market places for impact auctioning, and a give-back distribution impact support system, designed to incentivize increased levels of investment along the value chain. The practical approaches suggested by stakeholders fit well with the existing impact measurement and monitoring frameworks like GIIN’s IRIS and Intellecap’s PRISM and hold the potential to guide impact capital more efficiently by leveraging good practices.

The Financial Lives of Government Employees – Potential of Digital Finance in Sierra Leone

PUBLISHED: July, 2018

This report documents findings from research on the financial lives of government employees in Sierra Leone, commissioned by the Government to People Payments Project – Building Digital Ecosystem funded by USAID. Intellecap supported UNCDF, Government of Sierra Leone and Bank of Sierra Leone for conducting the research.

There are 80,000 government employees in Sierra Leone who receive salaries digitally in their bank accounts. Insights about their financial lives can help build a viable business case for DFS to expand access to a wide range of financial services for underserved communities in Sierra Leone. Such insights can inform strategies and use cases that the UNCDF and the Government of Sierra Leone can develop to promote DFS in the country. The National Strategy for Financial Inclusion 2017 – 2020 also refers to the need to identify and digitize use cases that will lead to habitual usage, and achieve Sierra Leone’s commitments to the ‘Better Than Cash Alliance’.

Recognizing the need and opportunity, UNCDF supported the Financial Lives Survey of government employees who receive their salaries digitally in Sierra Leone. Intellecap designed the survey to understand how government employees utilize salaries transferred into their bank accounts, their awareness of and access to DFS, avenues to use them and their perceptions about financial services and digital financial transactions. This report contains insights from the survey about potential customers of DFS and recommendations on use cases that could be piloted as an initial step to improve DFS adoption in Sierra Leone.

Replication of Intellecap’s Ecosystem Based Approach in East Africa

PUBLISHED: July, 2018

Intellecap has sought to replicate its ecosystem-based approach to East Africa by bringing

together capital, knowledge and networks to support SGBs at two levels: (i) provide direct support

to SGBs in the form of acceleration, fund-raising, technical assistance, innovation transfer, and

market linkages, and (ii) discover and engage critical ecosystem players such as corporations

(both local and international), accelerators, other development sector players in supporting SGBs.

In the three-year period since the launch of our initiative to replicate our ecosystem-based

approach for accelerating entrepreneurship support to SGBs in East Africa, we have received

generous support not only from our funders, but also from a number of local and international stakeholders such as development institutions, private sector entities, and industry associations.

Over the last year, we have replicated our advocacy platform (Sankalp), angel investment network

(I3N) advisory services (consulting & investment banking), virtual incubation platform

(StartupWave) and impact measurement platform (PRISM) as envisaged at the beginning of our

programmatic support. The development and adaptation of StartupWave for East Africa has

resulted in over 450 sign-ups for our early stage enterprise support activities and partnerships with

over 30 incubators / accelerators. Similarly, PRISM, our impact measurement platform, has

garnered interest from a wide variety of players to measure the impact of their programs.

All Publications

-

Transforming India into a Global Solar DRE Manufacturing Hub: A Study into Market Requirements and Readiness

PUBLISHED: September, 2022READ MORE -

GIIF Publication 2022 – Sankalp Africa Summit’s engagement with IFC’s Global Index Insurance Facility

PUBLISHED: May, 2022READ MORE -

Opportunities and Constraints of Women Owned Very Small Enterprises in India by International Finance Corporation (IFC) and Intellecap,

PUBLISHED: March, 2022READ MORE -

Designing for Inclusion within Circularity- A Prototype On-ground

PUBLISHED: September, 2021READ MORE - The Africa AgTech & Inclusive Insurance Challenge, where the Sankalp team identified promising enterprises in the AgTech and insurance space, supported them with investment readiness support and provided strategic exposure to investors from the Sankalp community.

- Strategic engagement at the Sankalp Africa Summit to leverage its knowledge-sharing platform to disseminate and share critical information on the agriculture and insurance sectors.

- Undertake a stakeholder mapping of the relevant actors within the digital agriculture ecosystem in Malawi, with a particular focus on local actors.

- Identify key challenges and opportunities to leverage digital technologies more effectively in the agriculture and allied sectors among stakeholders in Malawi, consistent with USAID/Malawi’s priorities.

- Identify key challenges and opportunities specific to Malawian women and youth in agriculture and aligned sectors concerning digital agriculture.

- Evaluate macro-level quantitative and qualitative data and develop recommendations to promote growth of DATs in the country.

- Understanding the business needs and challenges of women-owned and gender-inclusive microenterprises and small and medium enterprises in Kenya

- Exploring the varying needs of stakeholders to effectively channel capital with a gender lens

- Investigating critical market gaps in the gender lens investing ecosystem

- Identifying gender lens investing opportunities that address the structural challenges faced by women-owned and gender-inclusive enterprises

- Skill building and capacity building amongst Twirl’s women artisans to improve their income potential.

- Identifying and establishing market linkages that would generate demand for upcycled products made from post-consumer waste.

Transforming India into a Global Solar DRE Manufacturing Hub: A Study into Market Requirements and Readiness

PUBLISHED: September, 2022

About 800 million people across the world live without adequate access to electricity. Solar decentralized renewable energy (DRE) products continue to be a focal point of electricity access, supporting the underserved areas in developing countries. Traditionally the large-scale manufacturing locations and consumer markets have been in China and Sub-Saharan Africa/South Asia, respectively. However, post-Covid, this structure has been undergoing changes.

India has become a more competitive place for the manufacture of solar lighting products, as supply chain disruption due to the COVID-19 pandemic has increased the cost of imports. For example, between 2019-20 and 2021-22, there has been an estimated five times increase in freight costs for solar modules imported from China. Industry experts also advise that India has advantages due to its reliable supply chains, shorter lead times, and greater policy and SME support. The subject needed a closer look, and this report is an attempt toward that.

GOGLA and Intellecap have worked on the study titled “Transforming India into a Global Solar DRE Manufacturing Hub: A Study into Market Requirements and Readiness.” The research explores the status of Indian manufacturing for solar and takes a deep dive into various DRE components and products. It also makes recommendations and provides a strategic roadmap for the development of greater DRE product assembly and manufacturing in India.

1ST Sankalp West Africa Report 2022

PUBLISHED: August, 2022

1ST Sankalp West Africa Report 2022

13th Sankalp Global Summit Report 2021

PUBLISHED: May, 2022

Welcome to the Sankalp Global Summit 2021 Report!

We at Sankalp are ever grateful to the 292 speakers, including 2 Nobel Laureates, 10 program partners, and the 2521 participants who joined us from 104 countries across the world for the Sankalp Global Summit 2021 summit on “Mainstreaming Impact”. We thank our partners International Finance Corporation (IFC), Bop Inc, USAID Samridh, British Asian Trust, Cartier Women’s Initiative, O Farms, Energy Catalyst, & Bayer Foundation. In addition to this we also had the support of several Friends of Sankalp who supported the outreach & amplification of the summit. We had 29.2 million impressions for the Global Summit!

We also hosted our 2nd Private Equity Conference “Rendezvous” for growth stage enterprises; as well as the 3rd Edition of the CAIF conclave on circular textiles & apparels at Sankalp. We retained our core purpose of convening to create an ecosystem of support for entrepreneurs around knowledge, capital & networks. We hosted 58 knowledge sessions across core thematic areas financial services, climate change, gender & livelihoods, WASH, agriculture, circular economies, impact investing, & future of work; with cross cutting themes of women, capital & technology. In addition, we had over 25 booths that showcased innovations, & partners in our exhibition area. Our endeavor always was to maintain a balance of gender, & diversity to our panels with a strong focus on bringing out the voice of the Global South.

One of the key highlights of the summit in 2021 was the 8 moderators from mainstream & independent media who helped us navigate the conversations this year – this included BBC, CNBC, CNBC Awaaz, Forbes, IDR, & India Spend. #SankalpGlobal2021 Page | 4 Our Sankalp Awards remain the coveted “Oscars”of the impact world with 257 entrepreneurs applying this year. To narrow down to the best of the best, we hosted two investor screening committees, & a prestigious Grand Jury to select 5 global award winners. We also introduced a new ecosystem award and had 94,000 voters help us choose our first awardee! Many of our Award winners & semi-finalists have gone on to raise significant funding to help scale their businesses from their engagements at Sankalp.

Overall, we hosted 2855 hours of networking, & facilitated 956 one on one meetings at the Summit. We recognize that virtual meetings may not be ideal, but the ability to be inclusive, cost effective, and the scale it affords is of tremendous value to entrepreneurs as well as investors. We also hosted dedicated Deal Rooms between investors to meet other investors; investors to entrepreneur deal rooms, as well as a specific Female Founders Deal Room.

Taking it a step forward, at Sankalp we also hosted our 2nd Private Equity Conference “Rendezvous”; which facilitated 85 one on one meetings between entrepreneurs who were looking to raise upwards to $5 Million with potential investors.

In this report you will find highlights of the summit, as well as some key initiatives, and numbers related to the summit. Our agenda, & speaker lists can also be downloaded as annexures.

The real value of a virtual convening is that every session is recorded and the tremendous knowledge repository remains as a digital asset for anyone to access on our YouTube page.

We remain committed to building an ecosystem of support for the Global South and welcome you all to this journey along with us

Regards

Team Sankalp

GIIF Publication 2022 – Sankalp Africa Summit’s engagement with IFC’s Global Index Insurance Facility

PUBLISHED: May, 2022

On the sidelines of Sankalp Africa Summit 2022 , we engaged with IFC’s Global Index Insurance Facility (GIIF) as a Strategic Partner, in order to build the profile for Index Insurance on the African continent, and explore innovative structures for building the resilience of smallholder farmers, thereby supporting the ecosystem for insurance providers to thrive.

Given the size, scope, and scale of the Sankalp Forum in Africa, GIIF decided to plug into the Sankalp Africa Summit 2022 to leverage the existing network of stakeholders, such that they may be able to amplify the importance of insurance, and build support for the insurance ecosystem in the region.

GIIF’s engagement at Sankalp had two major components, which were:

This report captures the highlights of GIIF’s engagement with the Sankalp Africa Summit 2022.

Sankalp Africa Post Event Report 2022

PUBLISHED: April, 2022

This year’s Sankalp Africa Summit 2022 was an event like no other.

This was Sankalp’s first ever hybrid event in our 13 year history. When designing the event, we set out to drive as much engagement and value to the Sankalp community as possible. Given the uniqueness of our community, we couldn’t simply stream in-person content to a live audience. We therefore innovated on how we wanted to structure our hybrid event, and we decided to create separate programming for virtual attendees and for in-person attendees, so that everyone, no matter how they were able to join, was able to have an amazing Sankalp experience.

We hosted three days of virtual convening with more than 35 digital sessions, and one day of in-person convening. During our in-person event day, we experimented with an unconference style agenda where 85% of the content was contributed and delivered by our attendees themselves in informal ‘Discussion Zones.’ These zones had no stages, microphones, or screens – just good ol’ fashion face to face sharing of ideas, challenges, and inspirations for building our entrepreneurial ecosystem. Delivering this two-in-one programming structure was one of the most challenging for the Sankalp team, but it was by far the most satisfying event I’ve personally ever been a part of.

For many of us, the Sankalp Africa Summit 2020 was the last big in-person event any of us participated in, before we receded to our homes and computers for two years of Covid quarantine. I could not be more honored that the 2022 Africa Summit was yet again the trend setter, and one of the first big events hosted for the region and the industry. Though we were able to safely convene only about 300 people in-person, the smiles, the conversations, the coffee lines, and the meetings under the sausage tree were a welcome change from Zoom meetings in yoga pants.

The pandemic put our regional expansion plan on hold for the last two years, but that is back on our radar now. Stay tuned as Sankalp expands to West Africa later this year. Thank you to all of you, who once again put your faith in Sankalp that we could convene safely and continue to help provide critical linkages for the ecosystem during these tumultuous times. It is our privilege to support and build this incredible community year on year. Until we see you again, stay safe and stay healthy!

Warmly,

Arielle Molino, Sankalp Africa Lead, Intellecap

Malawi Digital Agriculture Ecosystem Assessment

PUBLISHED: March, 2022

Digital agriculture technologies (DATs) have the potential to address the challenges facing the agriculture sector in Malawi by transforming how agri-food actors access information, goods, and services. DATs consist of advanced digital innovations that enable smallholder farmers, agribusinesses, governments, and development partners to increase their productivity, efficiency, and competitiveness, thereby contributing to improved agricultural outcomes. Technologies such as mobile phones, drone and satellite imagery, moisture sensors, geographic information system (GIS), internet of things (IoT), and machine learning are playing a critical role in the agriculture sector enabling the actors to address key challenges along the value chains.

DATs present immense advantages and opportunities to advance the development of the agriculture sector. DATs can be applicable across several use cases. First, DATs help farmers to make more informed production decisions through accurate, timely, and location-specific, weather, and agronomic data advisory. Second, DATs reduce information asymmetry across the value chain enabling farmers to access timely information on prices and markets and directly engage with the buyers. Third, DATs streamline supply chains and reduce operating costs across value chains.

The growth, scale-up, and sustainability of DATs is highly dependent on an enabling ecosystem including the availability and accessibility of the foundational digital infrastructure and digital skills. This study, commissioned by the United States Agency for International Development (USAID) through DAI seeks to assess the digital agriculture ecosystem in Malawi to identify challenges and opportunities to inform USAID/Malawi Mission’s current and future programming. The key objectives of the study include:

This study was commissioned by the U.S. Agency for International Development’s (USAID) Bureau for Resilience and Food Security on behalf of the USAID/Malawi Mission and conducted under the DAI-led Digital Frontiers project. The report was authored by Intellecap with support from UMODZI Consulting Ltd

Opportunities and Constraints of Women Owned Very Small Enterprises in India by International Finance Corporation (IFC) and Intellecap,

PUBLISHED: March, 2022

This report presents a post COVID, cluster-based landscape of Women’s Very Small Enterprises (WVSEs) in India and quantifies the untapped credit opportunity. It builds the case for financial institutions to design targeted products for this segment and provides recommendations on how these can be deployed.

Women-owned very small businesses (WVSEs) in India, with an estimated credit demand worth INR 836 billion ($11.4 billion), need the strong support of financial institutions (FIs), as per this latest report from the International Finance Corporation (IFC), ‘Opportunities and Challenges of Women-Owned Very Small Enterprises in India’, enabled by Intellecap. This support will facilitate their growth and drive socio-economic inclusion by eliminating existing challenges.

Launched on the occasion of International Women’s Day 2022, the report says WVSEs face numerous challenges, including inadequate access to capital, technology and information, and infrastructure gaps. There are about 15 million women-owned MSMEs in India, and contrary to popular perception, over 70 percent of them are manufacturing enterprises, many of them home-based.

In addition to challenges mentioned, the segment of women entrepreneurs who often overcome biases from within the family and the business community, witness fractional treatment when it comes to lending. The report says FIs have traditionally catered to men-owned enterprises. The approach then limits the understanding of the operating contexts of women-owned businesses and their socio-cultural constraints. Given that most women entrepreneurs are self-financed, the lockdowns imposed during the COVID-19 pandemic have impacted their business and reduced their income.

This report identifies sectors that WVSEs operate in and highlights the characteristics of these enterprises. It also provides a granular perspective of WVSE business operations in each of the sectors including the nature of businesses they engage with and the intermediaries who provide support to them. On this basis, the report suggests ways for FIs to design new products and new processes to address the needs of WVSEs.

Authors:

Poorna Bhattacharjee/IFC, Srijan Kaushik/IFC, Anil Birla/IFC, Natalia Kaur Bhatia/IFC, Vikas Bali/Intellecap, Mukund Prasad/Intellecap, Amar Gokhale/Intellecap, Abhishek Gupta/Intellecap , Neha Kumar/Intellecap

DISRUPTIVE ROLES IN GENDER LENS INVESTING IN KENYA

PUBLISHED: March, 2022

Gender lens investing (GLI) is an approach to investing into companies, organizations and funds that takes into consideration gender[1]based factors across the investment process to advance gender equality and better inform investment decisions.

Although most funds that invest with a gender lens are based in and operate in the Global North, investors operating in developing countries have also started to adopt the practice in recent years, investing in women-owned enterprises and in enterprises that empower women as customers, employees, suppliers or distributors (termed as gender[1]inclusive businesses). Research demonstrates a strong business case for investing with a gender lens: companies which have women in leadership demonstrate higher share price returns, better attract and retain talent, and are more creative.

However, the scale of GLI remains small, despite increasing interest in this asset class. Women entrepreneurs attract a minority of global investments, receiving 2.3% of global VC funding in 2020. Lack of tailored funding, gender bias from capital providers, inadequate business and technical skills, lack of networks and patriarchal social norms are the key challenges restricting access to finance for women-owned enterprises. Gender[1]inclusive businesses struggle with limited access to information, lack of investor networks and a limited ability to measure their gender impact.

In Kenya, women entrepreneurs similarly struggle to access capital. Most women-owned businesses in Kenya operate informally and struggle to access capital from sources beyond friends and family, microfinance institutions and savings groups (such as Chamas and SACCOs) . Banks and investors often do not view them as potential customers. This is also the case for formal enterprises: although 34% of formal microenterprises in Kenya are women-owned, they account for 76% of the total financing gap for formal microenterprises in the country.

While progress is slow, multiple interventions by the government, donors and ecosystem support organizations are helping channel capital with a gender lens. Aspects such as local presence of impact investors, a growing number of women in business, improved educational attainment of women and a growing entrepreneurial support ecosystem have been enabling GLI in Kenya.

However, success has been mixed, with existing strategies and interventions being unable to sufficiently serve women-owned and gender-inclusive businesses. There is therefore a need for innovative and disruptive solutions to increase GLI in Kenya. This study builds on existing research through consultations with ecosystem stakeholders to identify persistent market gaps and challenges experienced across the GLI ecosystem and potential solutions to address these.

This research provides an in-depth assessment of the gender lens investing market in Kenya. This report builds on existing research through consultations with ecosystem stakeholders to identify persistent market gaps and challenges experienced across the gender lens investing ecosystem and potential solutions to address these.

The key objectives of the research include-

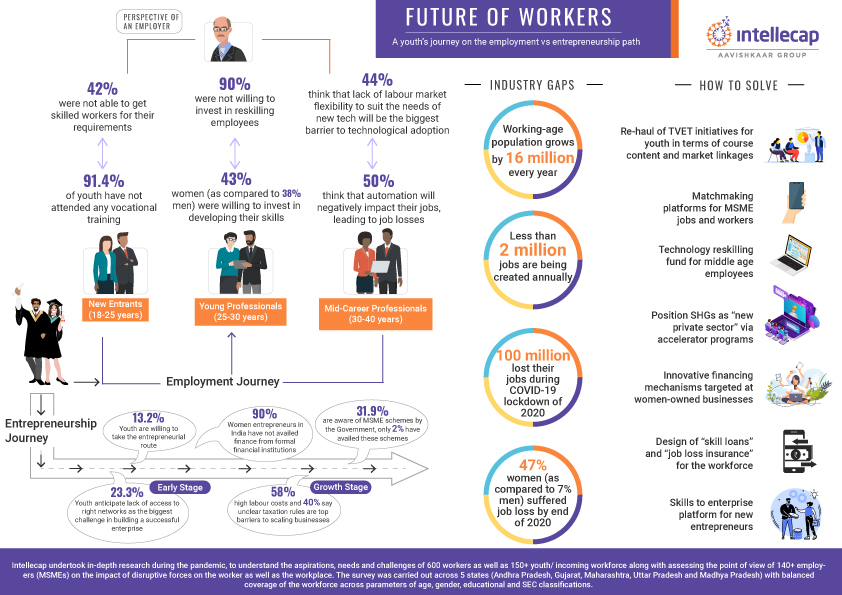

The Future of Work(ers)

PUBLISHED: November, 2021

Intellecap is proud to launch its ‘Future Of Work(ers) : A Way Forward’ Report, that brings to light its extensive research findings during the course of the pandemic to understand the aspirations, needs & challenges of the labor market in India.

The research included voices from the ground (over 750 existing and incoming workforce members and nearly 150 MSME employers) across 5 States of India; representing different contexts across geographic, socio-economic and cultural parameters of the respondents.

By evaluating the 3 key constituents in this ecosystem – incoming workforce/ youth, existing workforce and employers in the industry, Intellecap was able to build a roadmap that charts out the essential resources to improve the overall quality of the workforce, enable better market linkages, and support enterprises to raise the overall standard of living for their employees.

These measures are imperative to shape a more inclusive future of work(ers) in India.

We’ve distilled all our Report insights into an extremely detailed and easy to navigate infographic that takes into account the perspectives of key ecosystem actors, the gaps that continue to persist in the labour market, and finally the potential solutions that could transform the landscape for the workforce, and allow them the agency to choose their journey of employment vs. entrepreneurship.

Designing for Inclusion within Circularity- A Prototype On-ground

PUBLISHED: September, 2021

Mumbai, 8 September – Circular Apparel Innovation Factory’s Project Circular+ gave them an unique opportunity of innovative prototyping. From discovery of ideas to solution building through a working group led engagement; and finally testing on ground in the form of a pilot. The journey itself was a learning curve. It serves as a case study of collaboration and co-creation. CAIF’s efforts, along with their partners resulted in completing 120+ hours of virtual training that covered 19 structured modules on diverse facets of production and witnessed a remarkable change.

CAIF not only found increased skill levels among the women workers, but more importantly, their enhanced confidence, motivation and income potential was the highlight of the project.

Nancy Charaya from CAIF, Intellecap shares more in her blog on the CAIF Circular+ Case Study.

As we envision the fashion (incl. textiles and apparel) industry’s transition towards the circular economy, the adoption of circular business models that are both planet and people positive is crucial.

Project Circular+ (conceptualized, designed and implemented with support from Laudes Foundation), launched by Circular Apparel Innovation Factory (CAIF) in May 2020, was born from that vision. Circular+ aimed to create a model for collaborative and innovative prototyping for inclusive circular business models in India.

This case study captures several stages of the process beginning with the journey from arriving at the collaborative prototype (through an industry working group), from outlining the objectives of the prototype that informed the pilot design, to executing the pilot and learnings from it and finally articulating a few priority lenses that we believe can significantly inform the design of future interventions to scale planet and people positive impact through circular business models – both in India and beyond.

In short, the case study is structured in four (4) parts:

PART I – Getting to the collaborative prototype & defining prototype objectives

An innovation challenge was launched to surface existing circular business models, and 4 enterprises were shortlisted to become a part of the working group from an initial list of 20 enterprises we engaged with.

We curated a diverse set of industry stakeholders who represented points of view from brands, manufacturers, ecosystem enablers, venture capital, policy research and think tanks, accelerators, and technology enterprises who were directly or indirectly part of the fashion value chain. These 4 innovators formed 4 ideas labs within the working group, and each of them developed collaborative prototypes that were tested on the ground.

The jury selected one enterprise (Twirl.store) based on the scalability potential of the inclusive circular business model for piloting.

About Twirl – Twirl operates on an upcycling model geared to minimize post-consumer waste by providing a new life to unused clothes and diverting textiles/apparel waste away from landfills. It provides a solution for collecting and upcycling unused clothes lying in consumer wardrobes into aspirational handcrafted products while strengthening livelihood for women artisans.

PART II – Design and delivery of the prototype & its activities

To provide early evidence of success, the prototype had to meet two objectives:

The curriculum was designed in consultation with the Twirls team and a 3- month training program was delivered virtually via training partner i.e. Master G. Multiple other workshops were also conducted such as photography, gender training to build additional competencies and generate awareness.

Existing marketplaces with sustainability focus were identified as great potential partners for Twirl to unlock alternate sales potential. Some B2B partnerships were explored that helped create a stronger pipeline for regular orders.

PART III – Outcomes achieved, and the potential to scale

The women artisans at Twirl underwent 120+ hours of training through 19 structured modules to augment their skill sets and capacities related to different production aspects. Such extensive training (and handholding) has helped these women gain expertise in improving the quality of products aligned to market requirements and also to enhance their self-development.

The team was successful in helping Twirl launch its products on two online retail Marketplaces – Kakul and LBB and is in the process of delivering products to a third platform called Kiabza. On the B2B partnership front, the team supported Twirl to enter into a B2B partnership with Sirohi.

PART IV – Learnings from the prototype

Download the Case Study and read more here– Case Study Circular +

Read the CAIF Blog – Here

Reports & Policies

Our Impact Map

Sign up for our newsletter

© Copyright 2018 Intellecap Advisory Services Pvt. Ltd. - All Rights Reserved