-

BIS Infotech | December, 19, 2023

IoT in Agriculture: Sankalp Global Award Finalist CityGreens in BISinfotech Magazine

Read More -

Times of India | December, 12, 2023

Tamil Nadu’s blue carbon initiative offers key lessons for coastal states at climate summit

Read More -

National Herald News | December, 12, 2023

Global Commitments by Global Institutions at the 15th Sankalp Global Summit 2023

Read More -

CXO Today | December, 12, 2023

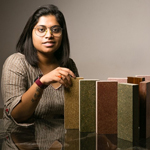

Building Tomorrow: Shriti Pandey’s Strawcture Eco Shines at Sankalp Global Summit 2023

Read More -

Youthki Awaaz | December, 12, 2023

Green Pioneers: 4 Startups Leading The Climate Change Charge

Read More -

GHANA MEDIA | June, 29, 2023

Four innovative young entrepreneurs honoured at the Sankalp West Africa Summit Awards 2023- Coverage of #SankalpWestAfrica2023 in Ghana Media

Read More -

CAPITAL NEWS | June, 29, 2023

Sankalp West Africa Summit 2023 Climaxed With Sustainable Fashion Show- Coverage of #SankalpWestAfrica2023 in CapitalNews

Read More -

MODERN GHANA | June, 29, 2023

Green Afro-Palms wins Sankalp West Africa Enterprise Award – Coverage of the Winner of the 1st Sankalp West Africa Summit Awards at #SankalpWestAfrica2023 in Modern Ghana

Read More -

Ghana Web | June, 29, 2023

Announcing winners of the 1st Sankalp West Africa Summit Awards 2023- Coverage of #SankalpWestAfrica2023 in Ghana Web

Read More